Business

China Less Susceptible To Demand-Led Inflation Despite Soaring World Inflation

May 9, 2022

February 14, 2024

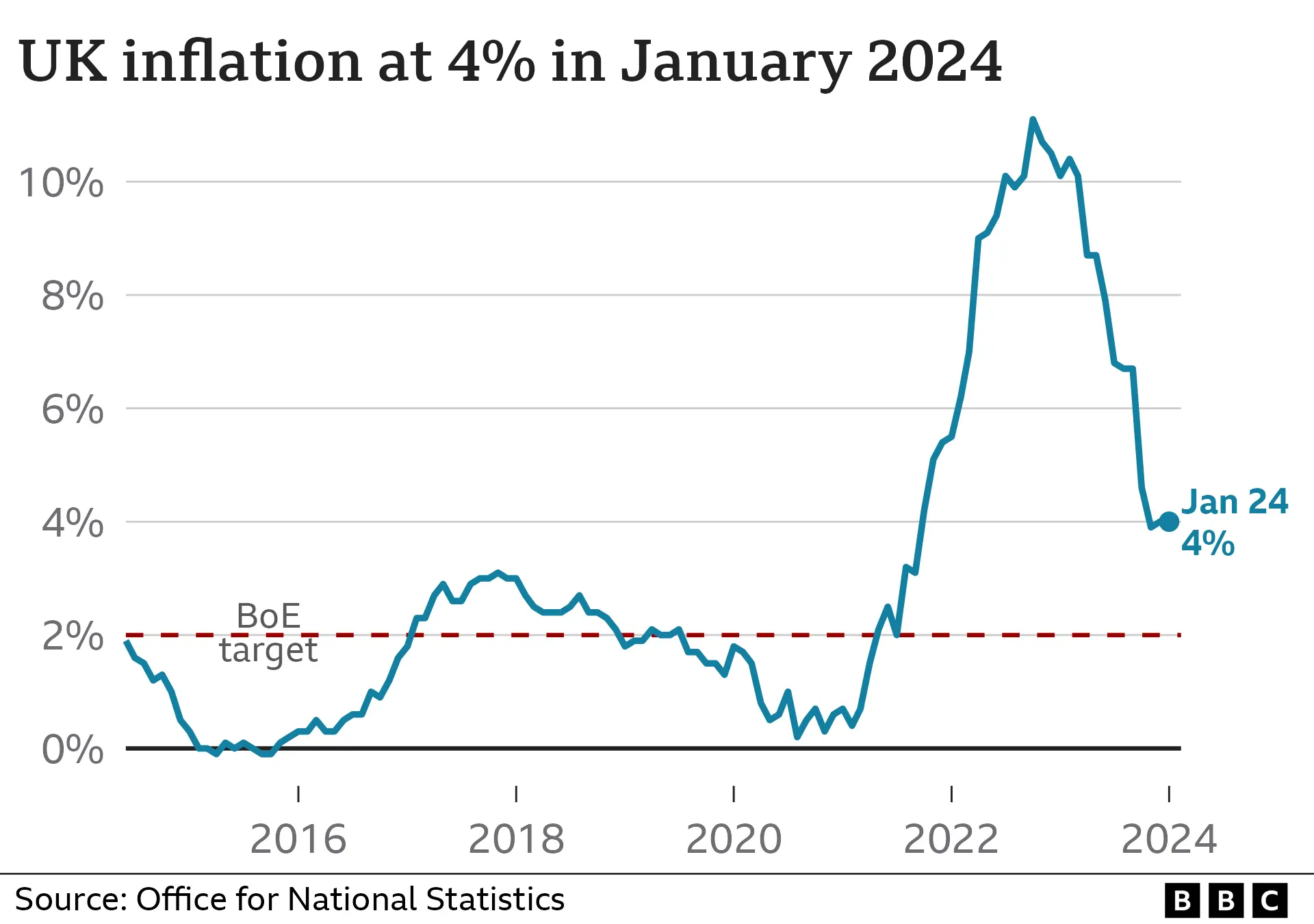

Inflation, which measures how prices rise over time, stood at 4% in the year to January.

The new energy price cap meant the typical annual household bill went up to £1,928, a rise of £94.

However, the price of other items like furniture and food fell, offsetting the increase in the cost of energy.

According to the latest figures from the Office for National Statistics (ONS), prices for food and non-alcoholic beverages fell on a monthly basis by 0.4%, marking the first decrease since September 2021.

Bread and cereals were part of the reason behind the fall, meaning things like cream crackers, sponge cakes and chocolate biscuits were all cheaper.

Crisps, cooking sauces and instant coffee all saw costs easing too.

Overall, food prices are still relatively high, however, with sharp rises seen in the past two years.

Price spikes followed Russia's invasion of Ukraine, which had a big impact on energy prices and grain supplies. Bad weather in Europe and North Africa and labour shortages in the UK have all affected crops too.

The biggest downward push on inflation in January came from furniture and household goods as retailers offered big discounts in a bid to clear the shelves after disappointing sales in the run-up to Christmas.

Meanwhile, the biggest upward contribution came from housing and household services, a category which includes the higher gas and electricity charges consumers have faced since January.

The price for second-hand cars also rose by 1.5% between December 2023 and January - the first rise since last May.

Grant Fitzner, chief economist at the ONS, said that the end result of all this was no change to what is called the headline rate of inflation.

He described the latest figures as a bit of a "mixed bag", speaking to the BBC's Today programme.

Chancellor Jeremy Hunt said: "Inflation never falls in a perfect straight line, but the plan is working."

He said that the government had made "huge progress" in bringing down inflation from its peak of 11%.

Despite the fact the figures on Wednesday beat economists' expectations, inflation still sits far above the Bank of England's target of 2%.

With inflation remaining much higher than this, the Bank has increased interest rates to 5.25%.

The theory is that by making borrowing more expensive, people will have less money to spend. They are also encouraged to save more as saving rates increase. In turn, this reduces demand for goods and slows price rises.

Source: BBC

Image: The Scotsman